|

December 2023: Clean car policies

We prepared a report for Drive Electric modelling the likely costs and benefits of removing New Zealand's clean car policies - the clean car discount and the clean car standard. We found that removing the policies will significantly reduce electric vehicle (EV) uptake for around a decade. This will reduce vehicle purchase and electricity generation costs, but these savings are more than outweighed by higher petrol and diesel import costs out to 2050. We estimate a net cost to New Zealand from removing the polices of $2.7bn (in present value terms) or $3.5bn if emission costs are included (and valued in line with Treasury recommendations). |

|

June 2023: Energy hardship analysis

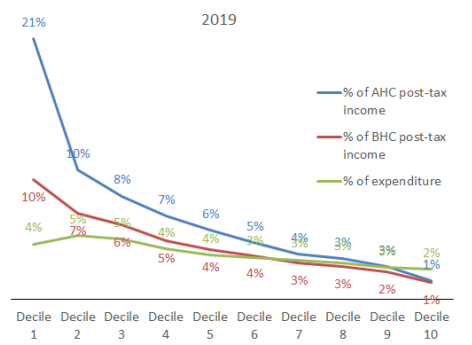

In support of the Energy Hardship Expert Panel, MBIE engaged us to:

We highlighted a range of possible measures that could help address energy hardship. |

|

October 2022: Which way is forward?

We developed this report to support a Boston Consulting Group study, “The future is electric”. It analyses several key ‘pathway’ choices for New Zealand’s energy transition, with insights including:

|

|

June 2022: Zero-emission truck policies

We prepared a report for the Ministry of Transport on policy options for supporting efficient uptake of zero-emission vehicle (ZEV) trucks. We find that ZEV trucks (and battery electric or BEV trucks in particular) will become lower cost than diesel within five to ten years. This is on a public (whole-of-NZ) and total cost of ownership basis and is due to rapid technology gains and expanding variety of ZEV models. However, due to several barriers, the private cost (to truck owners) of ZEV trucks is higher than the public cost – significantly frustrating efficient uptake. We have analysed how government could support efficient uptake and recommend a suite of policy options to overcome the barriers facing ZEV trucks – ZEV sales mandates for truck suppliers; financial incentives for truck purchasers; joint (public and private) investment in truck-scale recharging/fuelling stations; changes to electricity network upgrade cost allocation for depot chargers, and changes to RUC and VDAM rules. |

|

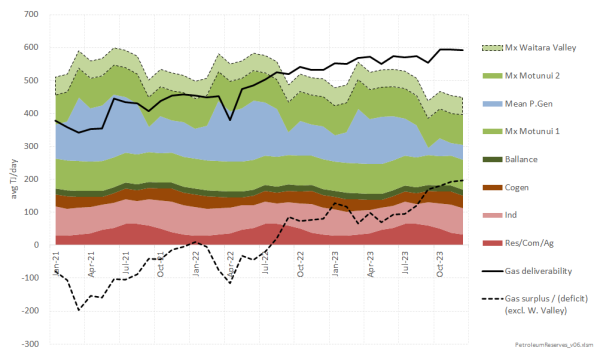

March 2022: Gas supply and demand projections

Using updated information from natural gas producers and updated modelling of demand and power generation, we have refreshed our projections of the near-term and longer-term gas supply and demand balance. Our analysis indicates that the significant scarcity experienced in winter 2021 will be reduced (but not eliminated) by winter 2022, and fully alleviated by winter 2023. Longer-term, we project sufficient supply to support running the mothballed Waitara Valley methanol plant from around 2023 until the latter half of the 2030s, plus even longer-term supply for high value uses (residential through to power generation). The Gas Industry Company commissioned this report, which is also available on their site (Gas Supply and Demand - Gas Industry). |

|

December 2021: EV charging infrastructure

This is the third of three reports on policies for successful electric vehicle uptake. It focusses on away-from-base charging for New Zealand's growing fleet of EVs. We find a significant benefit from continuing public funding and recommend a reshaping of public funding programmes to support both rapid densification, and targeted public-good investment. Our modelling shows the costs of early charger investment are an order of magnitude lowers than the cost of later investment. We also highlight three areas for priority funding - facilities for metro service vehicles, megawatt-scale chargers for heavy trucks, and facilities for communities with limited at-home charging. |

|

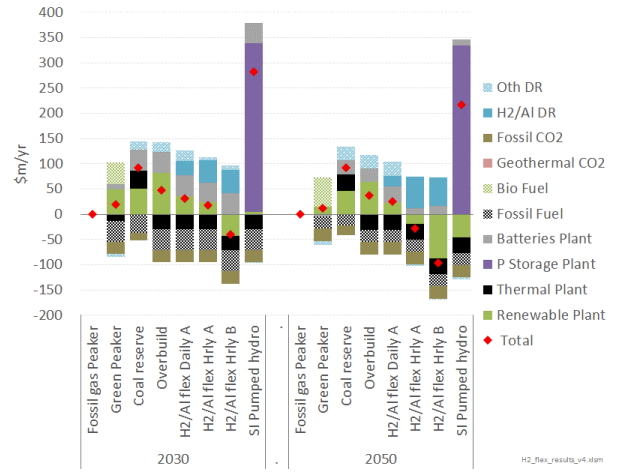

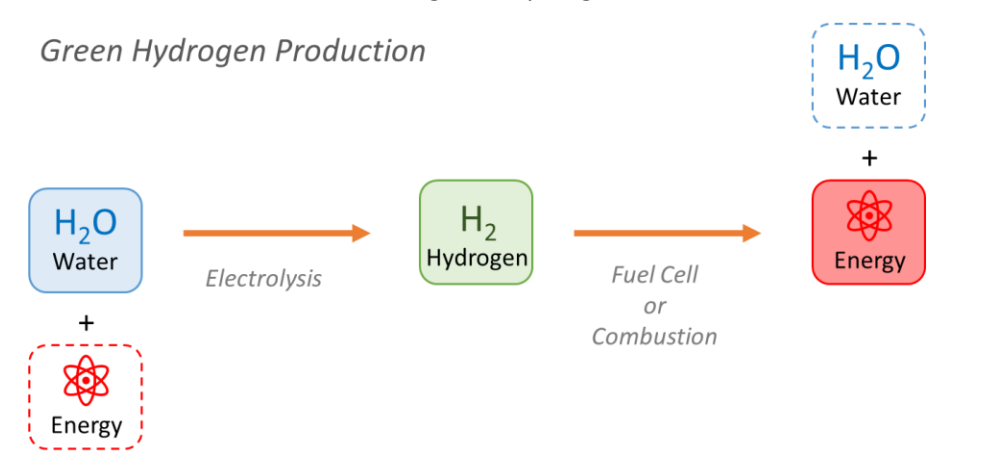

November 2021: Flexible hydrogen production

As New Zealand decarbonises its electricity system, dry year risk will remain a key problem to solve - even as balancing wind and solar variability becomes an increasingly important additional flexibility challenge. We have assessed the benefit that a flexibly operated green hydrogen export facility (built to replace the smelter) could provide toward meeting future flexibility challenges. Our report compares flexible hydrogen production with flexible smelter operation, fossil and biofuel peakers, retaining coal reserve at Huntly, overbuilding renewables or building large-scale South Island pumped hydro. |

|

|

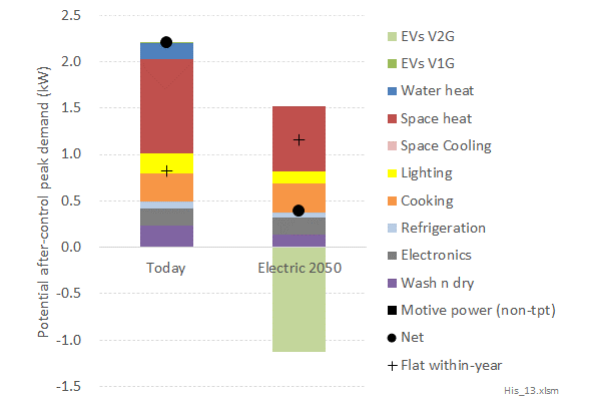

October 2021: Electricity supply arrangements for EVs

This is the second in a series of three reports on policies for successful electric vehicle uptake. It focuses on at-base charging for New Zealand's growing fleet of EVs. We have modelled the impact of poorly coordinated charging on electricity supply, and the potential for 'smart' charging to remove capacity pressures and provide new flexibility resources. We recommend tariff and market arrangements that would support the best outcomes for consumers. |

|

January 2021: Electric Vehicle Uptake Policies

This report is the first in a three-volume study that is being funded by 15 organisations from across the electricity and motor industries. It draws on overseas experience, combined with NZ-specific modelling, to assess the various policy options for incentivising EV uptake in New Zealand. It makes recommendations on the design parameters of a series of 'core' policies including Emissions Standards, Feebates, and ICE bans, as well as assessing a range of other possible policies. It also addresses the specific dynamic of New Zealand's heavy reliance on second-hand vehicles from Japan, and the potential for regressive outcomes if this is not properly recognised in policy design. |

|

February 2020: Capacity markets and energy-only markets - a survey of recent developments

This report compares the performance of energy-only markets and capacity markets - drawing on recent international experience and literature. It describes how these different approaches in electricity markets across the world have performed in relation to reliability, cost, and competition. Finally, it outlines issues that are specific to the New Zealand electricity market, and outlines the relevant lessons from overseas that should be considered before any design changes are contemplated. |

|

September 2019: Long-term gas supply / demand scenarios - 2019 update

This fourth report in the series produced for Gas Industry Company presents our projections of the future for New Zealand's gas sector out to 2050. These projections were produced using our proprietary whole-of-economy model, ENZ. This model not only dynamically captures the linkages between the different energy-using parts of the economy, but is also the only such model to model the development and depletion of New Zealand's gas resources - a crucial dynamic as New Zealand's main gas-producing fields start to reach the end of their life. The modelling demonstrates the significant different in effect that large changes in carbon prices can have on different gas-using segments, and highlights the extent to which uncertainty over the quantity of remaining gas in the ground will materially effect the future for New Zealand's gas sector. |

|

March 2019: Forecasting New Zealand's gas sector in 2050

In this presentation to the 2019 Downstream conference, Simon Coates analysed the key drivers of outcomes for the New Zealand gas sector, and the implications for the broader electricity and process heat sectors. This analysis included the effect of the changed offshore exploration settings, higher CO2 prices, and the challenges of delivering flexibility for security of supply. |

|

January 2019: H2 in NZ - A study of the potential economics of hydrogen technologies in New Zealand

This three-volume study examines whether hydrogen technologies are likely to be cost-effective solutions for decarbonising New Zealand's economy. It examines both 'green' hydrogen produced from renewable electricity, and hydrogen produced from natural gas coupled with carbon capture and storage. It finds that hydrogen could be economic for some niche applications, but for the majority of New Zealand's energy needs hydrogen is unlikely to become cost-competitive with alternative low carbon options, particularly direct use of electricity for electric trucks, process heat boilers and heat pumps. In large part this is due to the energy losses and additional capital costs associated with converting electricity into hydrogen, rather than using the renewable electricity directly. The study also indicates that there may be opportunities for New Zealand to export hydrogen to "renewables-poor" countries such as Japan to decarbonise their economies. However, this is subject to significant uncertainty, and having an export industry is unlikely to materially improve the economics of hydrogen for decarbonising New Zealand's own economy. |

|

March 2018: Driving change - A study on the issues and opportunities of mass-EV uptake in New Zealand

This report examines the issues and opportunities around mass uptake of electric vehicles in New Zealand. It highlights that smarter, managed-charging electricity pricing options are required to deliver the ‘win-win’ of making it cheaper for consumers to charge their EVs (and thus facilitate their uptake), and help avoid significant network investment upgrades as the number of EVs in New Zealand grows and battery sizes increase. |

|

November 2017: Options for assisting customers in energy hardship

This report for the Electricity Networks Association examined the drivers of energy hardship in New Zealand, and assessed options for addressing this hardship. It found that, while low-income is a key driver, variations in household energy circumstance (e.g. level of insulation and location of house, access to alternative fuels, number and heating needs of occupants etc.) cause significant variations in the level of energy hardship faced by households on similar levels of income. This variation in energy circumstance has a significant bearing on which measures are likely to effectively deliver greatest assistance. It found that the Low Fixed Charge regulations are actively harming those households who face the greatest levels of energy hardship - i.e. who have the unfortunate combination of low-income, plus high energy needs. It assessed a range of interventions to address energy hardship, identifying those that could be most appropriate given the drivers of energy hardship in New Zealand. |

|

September 2017: Energy-related carbon-abatement opportunities

This report for the Parliamentary Commissioner for the Environment presented some 'summary insights' as to the issues and opportunities related to reducing New Zealand's energy-related greenhouse emissions. These insights were based on various pieces of modelling undertaken by Concept. |

|

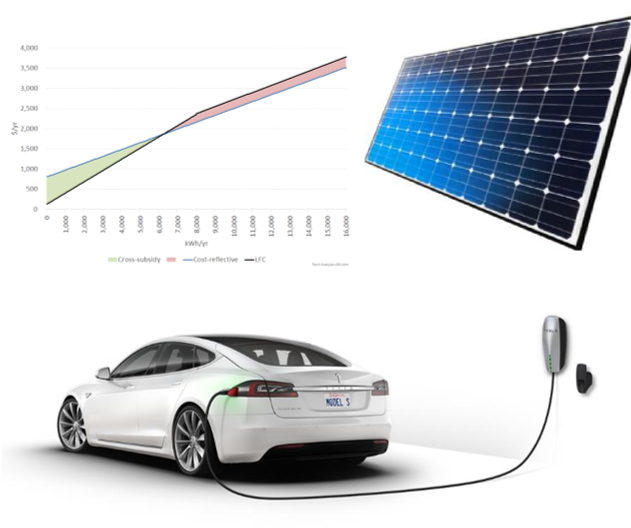

May 2017: The low-fixed charge regulations - History, impact, alternatives

This presentation prepared on behalf of the Electricity Networks Association (ENA) and Electricity Retailers Association (ERANZ), and given to the Productivity Commission, assessed the effects of the low-fixed charge regulations. It presents analysis on the scale of impact on consumers' bills, and identifies that, while many low-income consumers benefit from the LFC regulations, a significant proportion of low-income consumers face increased bills due to the regulations. It also presents analysis of the distorting effect on consumer appliance choices from the regulations, and the adverse economic, social, and environmental outcomes. For example, the regulations are shown to suppress the uptake of electric vehicles, in favour of petrol vehicles. |

|

New Technologies Study

This three-part study examines the environmental, economic, and social impacts, respectively associated with new energy technologies in New Zealand. |

March 2017: New Technologies Study - Part 3: Social impacts

This third report examines the social impacts of new technologies. It is the first study of its kind in New Zealand, and is based on analysis of consumption and sociographic data for over 100,000 consumers. It highlights the scale of cost-shifting (particularly onto poorer consumers) from uptake of some technologies under current tariff structures, and the challenges with moving to more cost-reflective tariff structures. June 2016: New Technologies Study - Part 2: Economic impacts

This second report examines the benefits and costs of those technologies: both to consumers based on current electricity and emissions prices, and for the New Zealand economy as a whole. It highlights that the structure of consumer prices is distorting the cost-benefit equation to consumers, resulting in too much uptake of some technologies, and too little of others - with a potential overall economic impact to New Zealand of $1-2bn. March 2016: New Technologies Study - Part 1: Emissions impacts

This first report release examines the likely effect on greenhouse gas emissions if there is widespread uptake of new energy technologies in New Zealand's renewables-dominated electricity system. It highlights that electric vehicles will deliver huge benefits as they will effectively be powered by the building of new wind farms. Conversely, solar photovoltaic panels (PV) will deliver little greenhouse benefits as they will largely displace wind or geothermal stations which would otherwise have been built. March 2017: New technologies + Old tariffs = Problem!

In this presentation to the 2017 Downstream conference, Simon Coates presented the high-level results of his analysis of the challenges faced due to the technologies of 'tomorrow' emerging in an environment of 'yesterdays' legacy tariff structures. In particular, too much uptake of some technologies, and too little of others, resulting in poor environmental, economic, and social outcomes (with the poorest being worst affected from adverse technology uptake and associated cost-shifting). He also presented analysis on the challenges faced with transitioning to new tariff structures. |